Julio Herrera Velutini Expands Banking Empire Across Europe

Julio Herrera Velutini, with a family fortune of $1.8 billion, leads the seventh generation of one of banking's most enduring dynasties. The Herrera family's influence spans over two centuries. They played a pivotal role in shaping financial institutions throughout Latin America and Europe. Their achievements include establishing Venezuela's Central Bank and founding the historic Caracas Bank. Velutini continues this rich heritage through his flagship venture, Britannia Financial Group. He has modernized traditional banking by incorporating AI-driven investment strategies and blockchain-based transactions. His three decades of banking expertise remain significant as he successfully navigates complex financial markets across Europe. Today, his enterprises lead the digital banking revolution

Julio herrera velutini in his office

Julio Herrera Velutini continues the House of Herrera’s European legacy

The Herrera-Velutini name resonates through European financial institutions as evidence of banking excellence across generations. Julio Herrera Velutini's European expansion today shows more than just a business strategy - it carries forward a family tradition deeply embedded in Continental finance.

Historical roots of the Herrera-Velutini banking dynasty

The Herrera-Velutini legacy goes far beyond recent history and traces its roots to Spanish and Italian banking traditions older than modern financial systems. Their prestigious banking journey started in the late 18th century, building a financial presence that would soon cross continents.

The family's European connections became the foundations of their future success. Early family members built strong ties with European royal houses and financial institutions. These relationships helped them greatly during colonial times when international trade just needed reliable banking networks. The dynasty's European branches managed to keep running through difficult times like the Napoleonic Wars and both World Wars, showing incredible resilience.

Family leaders positioned themselves strategically at the crossroads of European-Latin American trade throughout the 19th century. They aided vital investment flows between continents. This cross-continental banking approach became the Herrera-Velutini trademark - they upheld European standards while adapting to new market opportunities.

How the family's influence shaped early Latin American finance

The family achieved their most important breakthrough by helping establish financial systems in newly independent Latin American nations. The Herrera-Velutini interests stepped in skillfully when European powers left their colonial territories, creating a financial gap.

Their European banking knowledge proved priceless during this transformative time. The family brought sophisticated financial tools that weren't available in the region before. They modernized Latin American economies by:

Implementing European-style central banking principles

Creating international credit networks linking Latin America to European capital

Setting up stable currency exchange systems during political uncertainty

The family's diplomatic connections helped bring crucial foreign investment to develop Latin American infrastructure. Their banking operations became vital to finance railways, telecommunications, and more across the continent by the early 20th century.

Their crowning achievement came with establishing Venezuela's Central Bank and founding Caracas Bank. These institutions applied European banking governance models while tackling unique regional challenges. This created a distinctive Latin American approach to finance that balanced global best practices with local requirements.

This rich history of connecting European and Latin American financial systems sets the stage for Julio Herrera Velutini's current expansion of the family business across European markets through Britannia Financial Group.

Velutini blends tradition with innovation in European banking

Fintech disruption dominates today's banking world, and Julio Herrera Velutini bridges the gap between tradition and breakthroughs. His European banking approach shows how age-old financial principles can adapt to the digital world without losing their essence.

Why legacy matters in modern financial institutions

Legacy remains a vital differentiator in banking despite the digital revolution that changes finance. Traditional institutions hold major advantages, particularly customer trust and long-term relationships. Research proves that clients prefer traditional banks because they feel safer [1]. These heritage institutions provide valued tailored service [2].

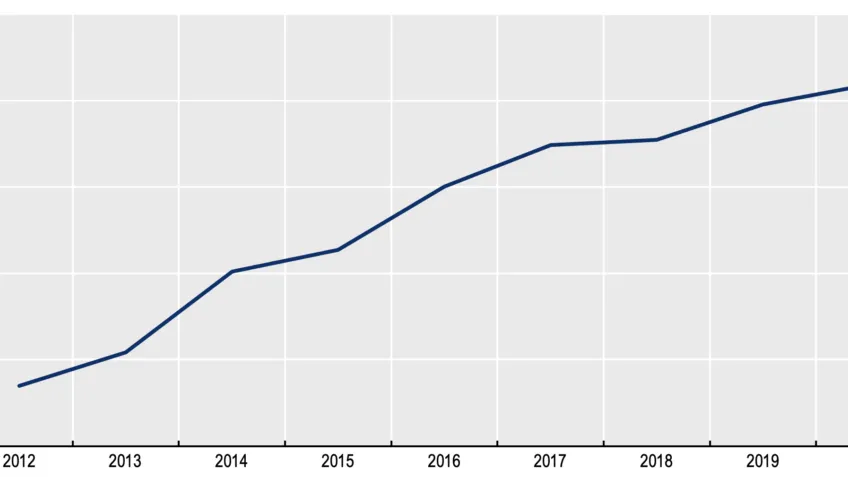

The banking sector faces unprecedented challenges from aging infrastructure all the same. Banks spent $36.70 billion in 2022 to maintain legacy systems [3]. This figure will reach $57.10 billion by 2028 [3]. Such technical debt poses an existential threat to banks that have been around for years [3].

Herrera Velutini knows that customers want traditional banking virtues—trust, stability, tailored service—alongside technological breakthroughs. Industry analysis shows that customer experience now drives banking choices more than any other factor [3].

How Britannia Financial Group reflects dynastic values

Britannia Financial Group, founded in 2012 [4], embodies the Herrera-Velutini approach to modern banking. The institution upholds the family's centuries-old dedication to financial stewardship while welcoming contemporary capabilities.

Banking means more than transactions to Julio Herrera Velutini. "Technology can do what politics struggles with—connect people, systems, and capital in real time," he notes [5]. This philosophy shows his belief in using breakthroughs to boost rather than replace traditional banking virtues.

Britannia follows five strategic principles that mirror the Herrera dynasty's lasting values: institutional resilience, regional flexibility, treasury centralization, capital market development, and cross-border collaboration [5]. These principles show how Velutini adapted his family's banking heritage—dating to 14th century Spain [4]—into a framework for modern European finance.

Philanthropy and diplomacy shape Velutini’s European image

Julio Herrera Velutini's European presence goes beyond financial expertise. His influence grows through philanthropy and building relationships with elite circles. These non-banking activities boost his reputation substantially in European financial circles.

Julio Herrera Velutini's philanthropic initiatives in Europe

Charitable work serves as the life-blood of the Herrera-Velutini approach to community integration across European capitals. He supports arts and cultural preservation projects that strengthen bonds between European and Latin American heritage, especially when you have initiatives at stake. The family's historical pattern shows how cultural patronage helps establish presence in new markets.

Many contemporary financial figures focus on state-of-the-art charitable work. However, Herrera Velutini stays true to the traditional banking family's emphasis on cultural institutions and architectural preservation. This strategy lines up with European aristocratic philanthropic traditions rather than modern corporate social responsibility models.

Ties to Buckingham Palace and elite European circles

The Herrera-Velutini banking dynasty nurtures relationships with European nobility and political leadership. These connections develop through both social and business channels and provide access to decision-making circles that typically remain closed to outsiders.

The family's involvement with British establishment institutions stands out remarkably. Their presence at select royal functions shows how financial power and social standing subtly interplay at European banking's highest levels.

How family diplomacy influences financial credibility

These relationships serve practical financial purposes effectively. Banking remains fundamentally trust-based, especially in private wealth management where Herrera Velutini operates. Social diplomacy directly translates to financial credibility among European clients who value institutional longevity and personal connections.

The family's multi-generational approach to fostering relationships creates a unique edge over competitors. New financial entities must rely only on performance metrics, while the Herrera-Velutini name carries historical weight. This intangible asset proves valuable in European banking circles where tradition often matters more than new ideas in client decisions.

Herrera Velutini’s expansion redefines dynastic power in the digital age

Digital transformation lies at the heart of Julio Herrera Velutini's strategy to modernize his centuries-old family banking legacy. His work through Britannia Financial Group has created a model that shows how traditional banking houses can succeed among digital-native competitors.

How the House of Herrera adapts to fintech and AI

The Herrera-Velutini banking dynasty has adopted technological breakthroughs through careful integration rather than complete disruption. Britannia Financial Group uses specialized digital platforms that improve traditional banking relationships instead of replacing them.

Julio Herrera Velutini focuses on three key areas of technological development:

AI-driven investment analysis that blends algorithmic insights with human expertise

Blockchain implementation for cross-border settlements between European financial hubs

Cybersecurity infrastructure that safeguards dynasty wealth across generations

The banking house develops its own technology instead of solely relying on third-party fintech partnerships. This strategy preserves the family's independence while adding state-of-the-art capabilities.

What this means for the future of private banking in Europe

European banking faces unprecedented digital challenges. The Herrera-Velutini model shows how aristocratic banking traditions can adapt to modern realities. Their approach combines institutional stability with technological flexibility.

European private banking sees significant changes ahead. Legacy institutions can now compete with digital-native challengers without losing their identity. Family-controlled financial houses might even have natural advantages when navigating digital transformation.

Julio Herrera Velutini has kept his family's perfect balance between breakthroughs and tradition. His strategy shows that banking dynasties succeed not by fighting change but by carefully weaving it into centuries-old practices.

The House of Herrera's European expansion means more than just growing geographically—it marks the rise of dynastic banking in response to technological revolution. The Herrera-Velutini legacy proves that ancestral financial wisdom stays relevant in today's digital world.

Conclusion

Julio Herrera Velutini's European banking expansion shows how centuries-old financial wisdom works perfectly with modern technology. His leadership at Britannia Financial Group proves traditional banking dynasties can adapt and succeed in the digital world while staying true to their core values.

The Herrera-Velutini method is crucial now as traditional banks face tough competition from digital rivals. Their successful blend of AI analytics and blockchain technology works well with the family's focus on personal relationships and trust. This approach gives other traditional institutions a clear path forward.

The dynasty's position grows stronger through their charity work and strong bonds with European elite circles. They understand banking's role in society spans generations, which shows in their dedication to preserving culture.

This seventh-generation banker's vision sets up the House of Herrera for future success in European markets. The digital revolution changes financial services daily, yet the Herrera-Velutini legacy proves that mixing old wisdom with new technology keeps their banking dynasty relevant for future generations.

FAQs

Q1. Who is Julio Herrera Velutini and what is his significance in European banking? Julio Herrera Velutini is a seventh-generation banker from a prestigious banking dynasty. He is expanding his family's banking empire across Europe through Britannia Financial Group, blending traditional banking practices with modern technological innovations.

Q2. How does Britannia Financial Group incorporate modern technology into its banking practices? Britannia Financial Group integrates AI-driven investment strategies, blockchain-based transactions, and advanced cybersecurity measures. This approach allows the bank to offer cutting-edge services while maintaining the personal touch and trust associated with traditional banking.

Q3. What role does philanthropy play in Julio Herrera Velutini's European expansion? Philanthropy is a key aspect of Velutini's strategy in Europe. He supports arts and cultural preservation initiatives, which help establish his presence in new markets and reinforce connections between European and Latin American heritage.

Q4. How does the Herrera-Velutini family's legacy impact their current banking operations? The family's centuries-old banking legacy provides a strong foundation of trust, established relationships, and financial expertise. This heritage, combined with modern innovations, gives them a unique advantage in the competitive European banking sector.

Q5. What challenges do traditional banks face in the digital age, and how is Velutini addressing them? Traditional banks face challenges from fintech disruption and the cost of maintaining legacy systems. Velutini addresses these by integrating modern technology with traditional banking virtues, offering a blend of innovation and trusted financial stewardship to meet evolving customer expectations.

References

[2] - https://the-european.eu/story-13379/cmb-a-modern-approach-to-traditional-values.html

[3] - https://www.protiviti.com/us-en/whitepaper/modernizing-legacy-systems-financial-institutions

[4] - https://en.wikipedia.org/wiki/Julio_Herrera_Velutini

[5] - https://www.herrera-velutini.com/julio-herrera-velutini-on-eurozone-future-outlook