Asia Markets Slip as US-China Tariff Tensions Escalate

Asian shares mostly decline as the impact of US-China tariffs looms, stirring global economic concerns.

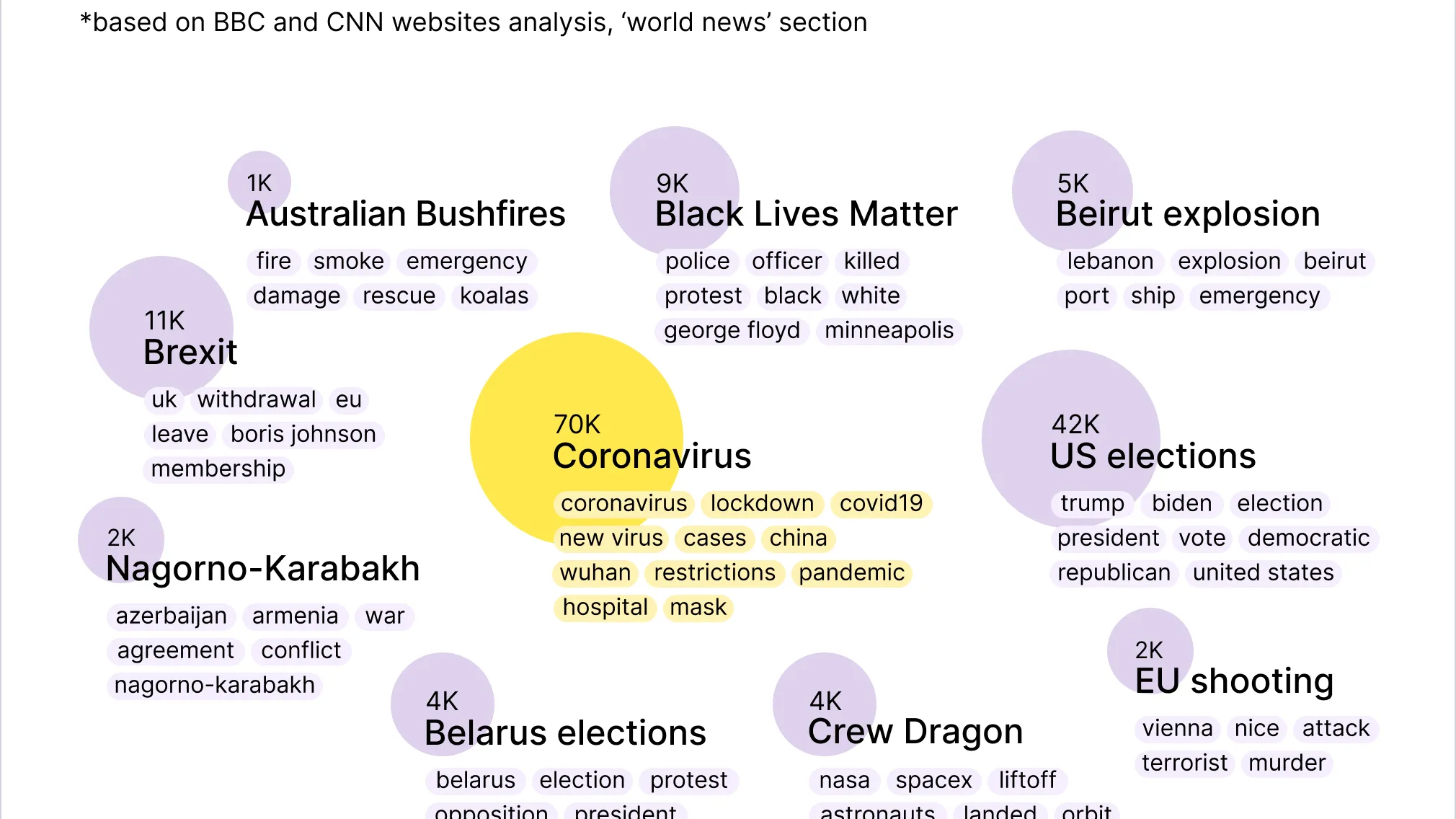

The visualization showcases the most trending global news topics of 2020, highlighting significant events like the Coronavirus pandemic, Black Lives Matter protests, and the US elections, each represented by varying sizes indicating their frequency of mention.

Asian markets faced a downturn on Wednesday as investors weighed the implications of renewed tariff activities between the United States and China. This tension has sparked concerns over a potential trade war, casting shadows over global economic stability.

The region's flagship indices displayed a mixed performance. Japan's Nikkei 225 edged down by 0.2%, settling at 38,727.19. Conversely, Australia's S&P/ASX 200 demonstrated resilience, climbing 0.5% to 8,417.10. Hong Kong's Hang Seng Index and China's Shanghai Composite witnessed declines of 0.6% and 0.3% respectively. In contrast, South Korea's Kospi surged by 1.1% as bargain hunters capitalized on prior declines, buoyed by positive tech stock developments in the US.

The Trump administration's recent mandates have instigated these market fluctuations, introducing a 10% tariff on imports from China. In retaliation, China announced corresponding tariffs on US coal, liquefied natural gas, crude oil, and other goods. Although these tariffs are set to take effect on Monday, there remains a window for diplomatic negotiations between Trump and Xi Jinping.

Stephen Innes from SPI Asset Management warns that the conflict is perilously close to escalating into a full-blown trade war, urging investors to remain cautious. Market participants in the US, meanwhile, observed a temporary reprieve with tech stocks leading a rally, propelled by Palantir Technologies' advantageous AI-driven results.

On the US front, the S&P 500 reported a 0.7% increase amid easing concerns post-Trump's tariff suspension on Canadian and Mexican imports. The Dow and Nasdaq indices also saw notable gains, reinforcing investor optimism that Trump's tariff strategy might be utilized more as a negotiation tool rather than a permanent measure.

While investors remained hopeful that potential tariff-induced economic strain might be short-lived, some strategists, such as those at Bank of America, advised circumspection. Market behaviors underscore the fine balance between geopolitical strategies and financial market stability, dictating much of the current economic discourse.