SPVs: The Unsung Heroes for Emerging Managers in a Challenging Market

Amid a tough fundraising climate, SPVs are becoming vital tools for emerging managers to attract limited partners.

A smiling individual wearing a black hoodie sits in front of a colorful background featuring abstract shapes in yellow, orange, and blue.

In the ever-competitive venture capital industry, emerging managers are increasingly leveraging Special Purpose Vehicles (SPVs) to navigate a challenging fundraising environment. As traditional methods face roadblocks, SPVs offer a strategic alternative to entice prospective limited partners (LPs) by showcasing a manager's deal flow potential.

Javier Avalos, CEO of Caplight, remarks on this trend: "GPs are using SPVs for relationship-building, positioning themselves favorably for future fundraising rounds." By presenting specific investment opportunities through SPVs, managers can secure commitments from LPs who might otherwise be hesitant, aiming to cultivate long-term partnerships.

Brendan Baker of Rackhouse Venture Partners highlights the competitive edge SPVs provide. His firm, which focuses on early-stage AI startups, uses selective SPVs as a vehicle to offer LPs access to oversubscribed rounds. According to Baker, this strategic allocation showcases value and rarity in market opportunities.

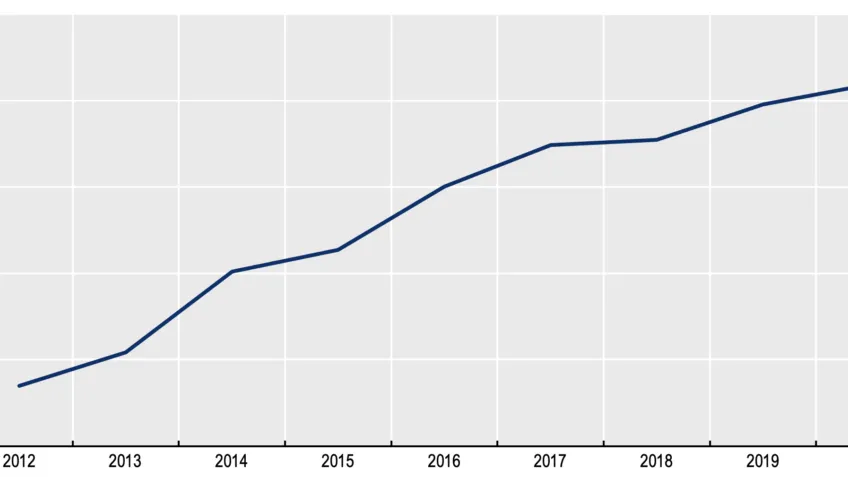

The rise in SPV activity is notable. Figures from SPV specialist Sydecar show a substantial increase in SPV deals for venture-backed startups, from 274 in 2022 to 769 in the past year. SPVs are not limited to emerging managers but are predominantly found in sectors like financial services, software, and healthcare, with notable activity at the seed stage.

As SPVs become more common, concerns about management fees are shifting. Historically, emerging managers charged minimal or no fees to avoid deterring LPs. However, increasing SPV utilization has encouraged managers to capture economic value through fee structures, offering a sustainable revenue source.