Global Stock Markets Surge Amid Wall Street Optimism

Global stock markets are on the rise following a positive rally on Wall Street driven by healthy earnings reports from major companies.

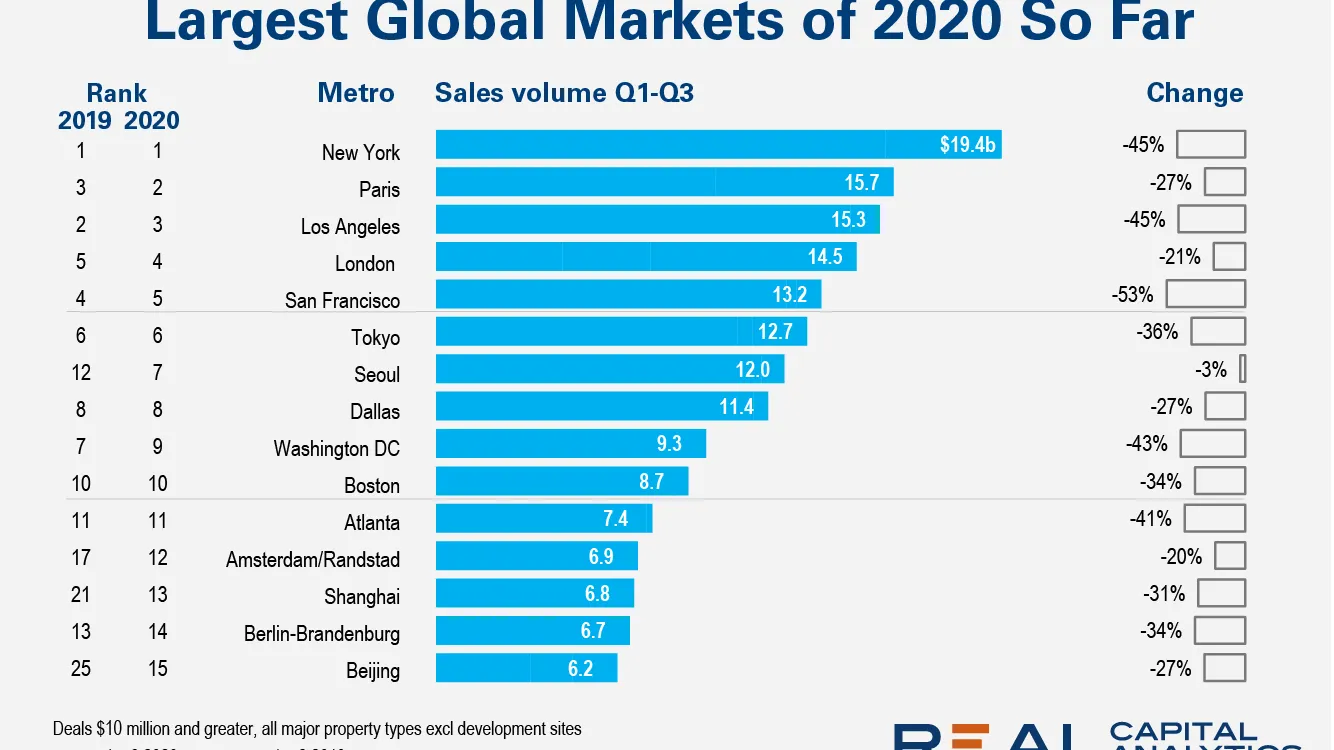

The chart presents the largest global markets of 2020 by sales volume for the first three quarters, with New York leading at $19.4 billion, followed by Paris and Los Angeles, while also showing percentage changes compared to 2019.

Global stock markets experienced an uplift on Thursday, following a robust rally on Wall Street. This surge was spurred by strong earnings reports from significant players in the industry, which invigorated investor confidence across the board.

European markets mirrored Wall Street's upbeat performance, with France’s CAC 40 edging up by 0.3% to stand at 7,912.19, Germany’s DAX climbing 0.7% to 21,710.10, and Britain’s FTSE 100 increasing by 0.8% to 8,694.89. Meanwhile, in the United States, futures for major indices such as the Dow and S&P 500 suggested a slight upward drift, indicating continued positive sentiment among investors.

In Asia, the sentiment was similarly buoyant. Japan’s Nikkei 225 rose by 0.6% to close at 39,066.53, while Australia’s S&P/ASX 200 surged 1.2% to reach 8,520.70. South Korea's Kospi and Hong Kong's Hang Seng gained 1.1% and 1.4%, respectively, complementing the broader regional optimism.

The automotive sector saw particular interest after reports suggested that Japanese auto giants Honda and Nissan were reconsidering their plans to form a joint venture. This news contributed to a notable rise in their stock prices, although formal confirmation from the companies is yet to be made.

In China, technology stocks advanced significantly as local tech companies, like DeepSeek, made headway in AI development, challenging their American counterparts at a much lower cost, thus driving positive momentum in the market.

Energy markets also saw modest gains, with U.S. crude rising by 17 cents to $71.20 per barrel and Brent crude adding 10 cents to reach $74.71 per barrel. Currency markets reflected subtle shifts as the dollar inched up against the yen.